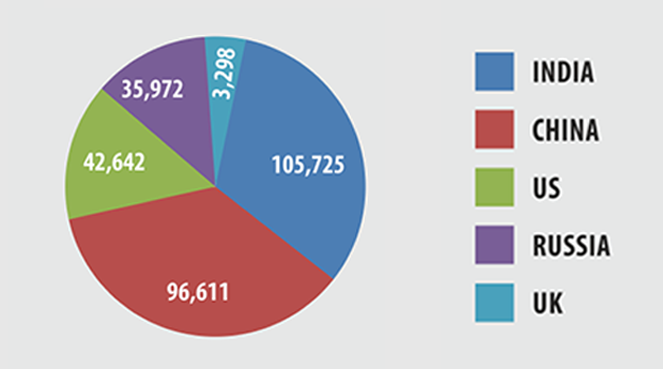

About 400 people die on Indian roads every day!

India is notorious for road accidental deaths.

Annual Cost of Road accidents is around 3% of India's GDP.

India has an alarming rate of road accidents. The perils of road accidents puts you and your family's security and health at risk. A motor insurance protects you and your family from risks & costs arising from damages to your vehicle as well as life and for third party damage also. A simple fixed premium for a vehicle insurance will negate financial risks that could arise from operating your vehicle.

Own damage to the vehicle caused by :

Personal accident cover :

This covers the financial cost of medical treatments of the members that were present in the vehicle during the accident.

Third Party Legal Liability :

Accidental death or injury to any third party. Bears the cost of damage to third party property.

On-the-spot Solutions

Towing facility.

Towing facility. Emergency evacuation.

Emergency evacuation. Bumper to bumper protection.

Bumper to bumper protection.

Copyright © 2024 - All Rights Reserved - InsureFirst

Design & Developed By Enhance Consumer Connect Pvt. Ltd.